I am/we are short RILY. All information for this article was derived from publicly available information. Investors are encouraged to conduct their own due diligence into these factors. This article represents the opinion of the author as of the date of this article. The information set forth in this article does not constitute a recommendation to buy or sell any security. This article contains certain “forward-looking statements,” which may be identified by the use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential,” “outlook,” “forecast,” “plan” and other similar terms. All are subject to various factors, any or all of which could cause actual events to differ materially from projected events. This article is based upon information reasonably available to the author and obtained from sources the author believes to be reliable; however, such information and sources cannot be guaranteed as to their accuracy or completeness. This article reflects the author’s opinion at the time of publication. The author makes no representation as to the accuracy or completeness of the information set forth in this article and undertakes no duty to update its contents. The author may also cover his/her short position at any point in time without providing notice. The author encourages all readers to do their own due diligence. We are also short APLD (mentioned herein) but that ticker is not the subject of this report.

- We believe B. Riley overstated its 2Q23 earnings by ~$28 million pre-tax due to an extremely inflated mark on an OTC holding called BEBE, a publicly traded company that is clearly impaired

- This inflated mark was taken in front of a $100 million+ equity raise that B. Riley took on to a) avoid cutting its unsupported dividend, and b) to fund its acquisition of FRG

- B. Riley acquired ~6% of shares of BEBE at around $3.60 in the 2Q23 quarter, but then nevertheless marked its remaining ~41% investment in BEBE at ~$7.80/sh on our math

- Comically, B. Riley is holding its 47.5% stake in BEBE at a carrying value higher than the current (and 6/30/23) market cap of BEBE

- There is clear evidence BEBE is impaired under GAAP – the business announced an intent to eliminate its dividend by May 2023 well before RILY finalized its mark

- The BEBE business itself appears to be a sham company and unconsolidated subsidiary of B. Riley – supposedly run by an 85-year-old man living in Southern California, operated out of ~500 sqft San Francisco rental, yet with a management team and Board almost fully comprised of employees/affiliates of B. Riley

- B. Riley now owns 47.5% of BEBE, controls the Board, runs the COO and Controller function for BEBE, and according to BEBE “has the ability to influence certain actions for day-to-day operations” – this investment is not only held at inflated values, but likely requires consolidation

- Additionally, BEBE IR informed me that Neil Subin owns 6% of BEBE – Subin is a 6% holder of RILY and worked alongside RILY to finance BEBE – he therefore appears to be a related party of B. Riley and should be considered part of B. Riley’s voting power, bringing B. Riley’s effective voting power over 50%, requiring consolidation

- If B. Riley is hiding bad marks like this in observable public securities, how can investors trust any of the marks at this company?

After our work on Applied Digital governance, we began to dig more deeply into B. Riley’s relationships with its captured portfolio companies. As a reminder, in the case of Applied Digital, we surfaced clear evidence that B. Riley had some type of “off the books” agreement with Applied Digital, allowing B. Riley to call the loan in early despite not having language in the loan documents permitting such a maneuver.

Our analysis suggests that B. Riley’s accounting practices are consistently aggressive. Additionally, with recent negative findings against their auditor, Marcum, we view the company as being at significant risk of regulatory intervention. Never have we seen a company mark a public security at almost 2x the value that it just bought it for in the open market and ~3x higher than the prevailing market price. Importantly, these aggressive practices appear to revolve around B. Riley’s extremely close relationship with recently SEC-sanctioned Marcum LLP. Marcum is not only the auditor for B. Riley, but also does audits for numerous B. Riley portfolio companies (for example we have confirmed AREN, FAZE, BEBE, and APLD are all Marcum clients). The relationship is clearly problematic and overly cozy as B. Riley appears to serve as a source of business for Marcum (it often holds Audit Committee seats at the companies it invests in and appears to steer companies to use Marcum). As a reminder, Marcum has a long history of getting in trouble for its business practices – the two most notable are the 2019 PCAOB sanction for promoting client stocks at its own penny stock conference, and the more recent 2023 SEC and PCAOB order for bad SPAC audits.

In the example from this report, we show a lesser-known B. Riley transaction that we believe overstated B. Riley’s earnings by over $28 million before tax in the most recently reported quarter – ahead of a pivotal equity capital raise to fund an acquisition of FRG and maintain an obviously unsupported dividend.

Today B. Riley owns 47.5% of BEBE, an OTC company with a ~$25mm market cap as of writing this note. We think the company is playing games with its ownership stakes to avoid consolidation accounting. Some years ago, B. Riley converted its debt position in struggling teen apparel retailer BEBE for equity. As a result, B. Riley ended up with a stake in the company of around 40% of shares outstanding. It then bought another ~7.5% of BEBE in the open market in 2023, with most of those purchases taking place in the 2nd quarter of 2023. Bebe is essentially out of the teen apparel business today, earning some small fees associated with the legacy BEBE brand via a JV. Its primary business today is operating around 60 Buddy’s Home Furnishing Stores – most of which were acquired from Franchise Resource Group (yes, the same Franchise Resource Group that B. Riley is about to acquire).

It is noteworthy BEBE has been buying franchise assets from FRG for the past several years – with B. Riley and Milfam (Neil Subin) providing financing to get these transactions done. Now that B. Riley is officially acquiring FRG, the daisy chain of connections between B. Riley and its portfolio companies grows exponentially, enhancing the possibility that these investments should all be consolidated.

Investors should review the history of Brian Kahn, Vintage Funds, FRG and B. Riley. Some years ago, B. Riley was involved in one of the most colossal mistakes in the history of investment banking, forgetting to send in basic paperwork to extend a deal that Brian Kahn made for Rent-a-Center, resulting in the client – Brian Kahn’s Vintage Funds – paying a $92.5 million deal break fee. B. Riley could have easily been destroyed if it had paid any share of that deal fee, but it ultimately walked away with zero liability after a rushed settlement that burdened the entire breakup fee on Vintage Funds.

Flash forward to today, and despite the massive deterioration of FRG operating performance, B. Riley moved forward with helping to finance Brian Kahn’s “management buyout” of FRG. It is our opinion that B. Riley has been trying to “pay back” Brian Kahn for the enormous $92.5 million break fee setback from years ago (notably B. Riley never paid any share of the break fee). We come to this conclusion because a) Applied Digital shows that B. Riley has a strategy of striking “under the table” deals with companies and clients it works with, b) we can’t make any other sense of why B. Riley stepped up to finance the sales of FRG furniture rental franchises to BEBE, a teen apparel company, and c) we can’t understand why B. Riley participated in a clearly overvalued transaction at $30 a share for FRG when the fairness opinion arrived at a range of $10.25 to $22.50 a share (p44). Point C is compounded by the fact that FRG is clearly falling apart based on recent results.

Given B. Riley’s business tactics, we think regulators and auditors would be well served to probe whether there are any “under the table” agreements between Kahn and B. Riley tracing back to the Rent-A-Center break fee that drove this acquisition as it will help dictate whether these entities should be consolidated.

B. Riley Mysteriously Added Significantly to BEBE Position In 2Q23 But Did Not Adjust Mark

As of writing this note, BEBE is trading ~$2.50 a share. It has been trading below $3/sh since May 2023. The last trade with any volume prior to B. Riley closing its books was for $2.70 in June 27, 2023.

Amazingly, B. Riley is holding its overall investment in BEBE at $7.20 a share as of 6/30/23. That is ~3x the fair market value of the stock. And this is even though B. Riley acquired an incremental 6.2% ownership stake in BEBE during the 2nd quarter of 2023 at around $3.61/sh based on our math and the timing of large block trades that hit the tape (see below, we pulled the trading volume during the time B. Riley acquired its stake and found large blocks traded at certain intervals consistent with the amount of stock B. Riley needed to acquire to grow its stake to 47.5% of BEBE). So, B. Riley literally decided to mark its investment in BEBE not only above the prevailing market price of the stock , but also above the price it literally just paid for the shares.

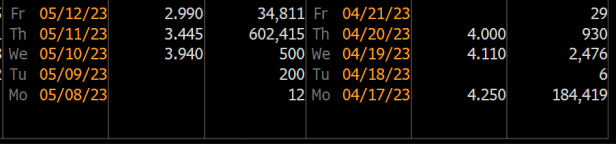

Here is trading data we utilized to inform the approximate prices B.Riley paid – these are the only large trades that hit the tape in 2Q.

Additionally, per their own filings, the market cap of the entire company is below the carrying value of their <50% share of the company…this is so nonsensical that it puts the whole situation in context:

(The current market cap of BEBE is around $30 million and they own less than half of it!).

Let’s walk through the math above more closely. B. Riley acquired about 800K shares in the 2nd quarter. When we look at the value of large blocks traded during that time, we can deduce that B. Riley spent about $3.61 a share on acquiring these 800K shares. Clearly, B. Riley could not possibly mark the value of these shares up immediately because it would need to put them in at their just acquired cost using the equity method of accounting.

If we assume B. Riley did the right thing and marked the new BEBE investment at its recently acquired 2Q23 cost, that means that B. Riley marked the rest of its BEBE position at ~$7.84 a share in the second quarter of 2023 despite the fact that the company’s stock price has been in a straight slide down and was trading under $3/sh on June 30, 2023.

Of course, this is nonsensical. How can one lot of shares be worth less than the other lot of shares? The shares are entirely fungible. What logic could B. Riley apply to claim that the recently acquired shares would be worth less than the legacy shares? The only possible logic would be if B. Riley is assigning a control premium to its own share ownership – in which case, this would be a tacit admission that B. Riley controls BEBE (despite disavowing control to avoid consolidation accounting). It appears to us that acquiring a 6% stake in BEBE at a massive discount to carrying value qualifies as “non-temporary impairment“.

The chart below shows that over the past year, BEBE has not even traded at the price that B. Riley appears to be using for its mark. It’s barely even traded above $7 over the last year and has been on a consistent and straight line down for the entire trailing 12 months.

B. Riley had an accurate comp from which to value its shares of BEBE – its own acquisition price. It should have clearly marked the investment at the price it just paid for it.

But instead, B. Riley relied on the following language to avoid marking down its shares of BEBE (from the 10Q).

As of June 30, 2023, the carrying value of the Company’s equity method investment in bebe exceeded the fair value based on the quoted market prices. In consideration of these facts, the Company evaluated its investment for other than temporary impairment under ASC 323. The Company did not utilize bright-line tests in the evaluation. Based on the available facts and information regarding the operating results of bebe, the Company’s ability and intent to hold the investments until recovery, the relative amount of the declines, and the length of time that the fair values were less than the carrying values, the Company concluded that recognition of impairment losses in earnings was not required.

The stock has been in decline for well over one year (essentially always trading below carrying value), and the price that B. Riley is marking it at is a price that has not even been observed in the stock for several years. But given RILY is using the equity method, perhaps the operating picture is better than it seems and that is letting B. Riley get away with not taking an appropriate mark?

Turns out that is also false. In its last financial filing, BEBE revealed that it intended to entirely cut its dividend for the quarter ended July 1, 2023 (see page 21). B. Riley undeniably knew about this fact when it filed the 10-Q because it holds most of the control of BEBE and in fact instituted the new policy! A dividend cut to zero – after years of paying dividends – is a clear as rain sign that there is operating impairment taking place at BEBE. According to PWC, cessation of a dividend is evidence that the decline in the value of shares is more than temporary (the stock paid 15c a quarter until last quarter when it paid only 2c, and then indicated it was cutting the dividend to zero). So not only has the value of the investment been below B. Riley’s cost for a prolonged time period, but the dividend has been eliminated, and B. Riley itself acquired a large chunk of the company at below carrying cost! What more do you need to see to take an impairment?

So, we started to wonder, who runs BEBE given the company is out of the apparel space?

The company still claims its CEO is Manny Mashouf. Mr. Mashouf is around 85 years old according to Wikipedia and he lives in Los Angeles. He used to be a fairly prolific poster on Instagram but has not been active for around one year. He also does not live in San Francisco where the company is now headquartered, nor does he have any experience in low-income furniture rental companies which is what BEBE essentially does today as the owner of 60 Buddy’s Furnishing franchise stores.

We traced BEBE’s headquarters to a 504 square foot rental unit in San Francisco CA. It is not clear what if any business activity is actually being done out of this unit, but it certainly does not look like a legitimate business headquarters for a company running ~60 franchises in the Southeast US.

So, we looked at the other members of the company. Corrado Federico is a longstanding member of BEBE’s board and pre-dates B. Riley’s involvement. We traced Mr. Federico to Sanibel, Florida. He is currently 82 years old. He is still a member of the BEBE board of directors. He is clearly not living in San Francisco and like Mashouf, he also has no experience in the furniture rental industry. He is also apparently no longer active in the real estate business – while the BEBE 10-K says that he presently serves as the President of Corado, Inc. it turns out that Corado, Inc. was set to inactive status in 2014.

What about the other board members?

First Perry Mandarino and Nick Capuano – both of these are B. Riley employees. So at least 2 of the 5 people on the Board are on the B. Riley employees.

Darrin Klotz is listed as an independent director. We note that he appears to have a family member named Lauren who is an employee of B. Riley. We confirmed that both are linked to the same residential address, and additionally Lauren’s LinkedIn profile includes a job at Lido Equities Group, the business Darrin Klotz founded and runs per BEBE financial filings (see p9). BEBE is OTC listed so director independence is a murky subject, nonetheless, B. Riley has significant control over the Board of Directors, especially given that we question how involved Mr. Federico is at 82 years old. Family members of current employees likely do not meet the threshold definition of “independent” under a more rigid standard.

But this is what struck us as the most amazing revelation from BEBE financial disclosures:

Here we find out that BEBE’s COO and Controller are both B. Riley employees. As we pointed out earlier, we have serious questions about whether 85-year old Mr. Mashouf who lives in Los Angeles and has no experience in furniture rentals is controlling this business in any way today. It appears that he is not. Instead, BEBE appears to be functioning as a shell company for B. Riley to park assets that it does not want to park on its own balance sheet due to consolidation rules. In fact, BEBE itself discloses that B. Riley “has the ability to influence certain actions for day-to-day operations”. This is the very definition of control.

We found this document showing the holders of BEBE as well as of last year (B. Riley subsequently bought more as mentioned above).

Notably, Mr. Neil Subin of MILFAM owns 6% of BEBE according to investor relations (their email response to me is provided below). Mr. Subin is a 6% holder of RILY and is an effective related party of the company per their own definition of related party.

So even if B. Riley wants to hide behind 47.5% as being below the consolidation threshold (despite having control by BEBE’s own admissions), with Neil Subin’s shares included they clearly go over 50% of voting shares.

In summary here is what we have:

- B. Riley continues to mark an asset at anywhere from 2-3x its fair value despite obvious signs of impairment including trading below carrying value for an extended time period and a complete dividend elimination. This treatment appears to be a violation of GAAP.

- B. Riley’s earnings have been inflated to the tune of at least ~$28 million pre-tax thanks to this bad mark

- The inflated mark was maintained in front of a $100 million equity raise despite obvious new negative information that should have led to a significant write-down

- B. Riley has a direct 47.5% ownership of BEBE but on top of that controls the Board and controls daily management positions including the COO and Controller position – yet claims it does not need to consolidate the company!

- Even if B. Riley is hiding behind being under 50% ownership to avoid consolidation, B. Riley and its related parties (Neil Subin of MILFAM) own over 50% of BEBE (according to BEBE IR) yet B. Riley does not consolidate BEBE on its balance sheet

We think B. Riley is being incredibly misleading in its accounting and in its disclosures around the nature of control it exercises over companies that it invests in. The BEBE example also calls into question whether B. Riley is appropriately marking its investment stakes.